The ripple effect from the global economic downturn continues to affect the way organizations behave in the marketplace. Surviving companies must now determine how they will thrive in an era where the balance of power has shifted into customer hands, causing tectonic shifts in how functions and people need to work together.

In the October 2013 report “Competitive Strategy in the Age of the Customer,” Forrester Research analysts predicted we are in the beginning of a 20-year business cycle they’ve dubbed the “Age of the Customer, in which empowered buyers are demanding a new level of customer obsession.” In a study with business customers across a wide variety of industries, The Corporate Executive Board Co. estimates buyers are “already 57 percent of the way through their buying decision” when they reach out to make a purchase from a supplier.

Source: GP Strategies, 2014

The Age of the Customer is also affecting how people work. There is a divide between executives, sales, marketing, HR, learning and operations leaders. Today’s talent leaders in the learning function must acquire buy-in across multiple business units and leadership levels for their initiatives to be successful. This is no small feat given the amount of change they face navigating “who’s in charge of what,” or “passing the hat,” to acquire necessary funding.

Worse, many C-level executives don’t really want to be educated on the importance of developing their people. CEOs get it. They just don’t want to have long drawn-out meetings about the importance of a having a learning strategy in place.

CEOs understand that new strategies require different execution on the front lines. The lag time between strategies being set and execution in the field is simply taking too long. People need to respond faster todrive different processes and different ways of working. It’s getting harder for executives to draw a direct line between talent management activities — such as training and skill modeling — and their pay off.

Siloed functions must learn to work together to drive results. For instance, product launches require product, marketing and sales training groups to work together to create compelling playbooks that use the customer’s business problem as the design point. People in those functions need to have an integrated view of how company offerings come together at the buyer’s desk.

Defining how critical roles must evolve to the future state often involves sales, marketing and business unit leaders. “With the increased pace of change and added complexity our people face, the role of training continues to evolve,” said Terri Kachinsky, a senior training consultant at Transunion, a financial data services company based in Chicago. “When you look at how business strategies are shifting, people across the organization need help to develop new skills and behaviors in support of that strategy; that goes way beyond simply building a course.”

Business Leaders Want Services

Learning leaders know they must change their approach. They need to act faster, align clearly with where the business is going and think ahead to what needs to happen, not just respond to requests. For example, in some organizations executives are moving from a cost-cutting mindset to one focused on growth. These executives don’t really care what courses need to be created. They just want to know if the new ways of work needed to tackle the reality in the trenches are ready or on the way.

Source: GP Strategies, 2014

Learning teams must be tactical and strategic. They need to think through, execute and operate with both a short- and long-term time horizon in mind.

Blending top-down and bottom-up thinking while managing both the short-term and the long-term time horizon creates valuable services the executive team can benefit from. These services provide a way to translate corporate strategy into day-to-day efforts that improve employee performance and are holistic not fragmented and deliverable-centric approaches like creating courses and programs.

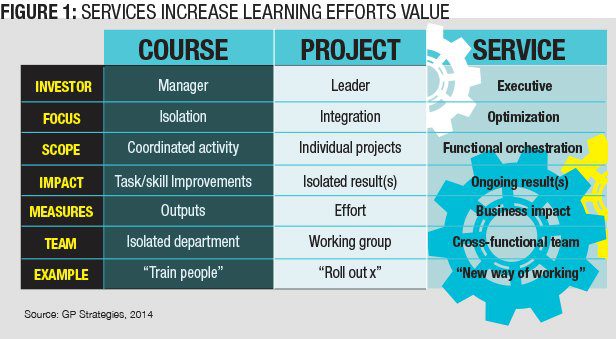

Executives often consider services valuable because they are more turnkey and integrated from end-to-end (See Figure 1) — such as recruiting-to-revenue services for sales hire, management coaching, sales kickoff and product launch support services.

There are many performance gaps within the average organization that learning teams can help overcome with a services approach. “Performance gaps may stem from individual, team or organizational issues,” said Thomas Quinn, program manager at the College of Leadership at FMC Technologies, a global technology company for the energy industry based in Houston. “We work hard to network with our internal clients regarding opportunities where we can help.”

For example, help salespeople change sales conversations or work cross-functionally to decrease new-hire ramp-up time. These kinds of cross-functional endeavors where there are many “moving parts” can create lasting business impact.

Source: GP Strategies, 2014

Finding Value

For a value-added service to be successful, it must convert individual and organizational needs into valuable business outputs in ways executives consider investment-worthy. A service should make all issues less visible and more manageable.

To create value-added services close the strategy to execution gap; help people work differently in critical roles. Support different line of business leaders’ efforts to overcome an array of challenges.

Consider the following checklist to determine what value-added services are necessary:

- What is the definition of success? (See Figure 2.)

- What business outcome will the service provide?

- What is the domain for the value-added service? Will it focus on new hire training or improving leadership talent?

- What are the clear performance expectations for each work cohort?

- How will the service help the company marry strategy and execution?

- What time and resources are required to drive the program?

- Who outside learning is needed to create and deploy the service?

Once the learning team and business partners collaborate to identify a potential value-added service, the group also must identify key contributors and beneficiaries. Analyze the service from the top down to communicate the effect clearly to internal stakeholders and external beneficiaries (See Figure 3). To ensure future effect, answer the following questions:

- Who are the customers for the service? The sales team or the customer service team?

- Who are the beneficiaries of the service? End-user customers, or the senior level and government employees who interact with them?

- Who are the investors for the service? The board of directors or the CEO?

- How will leaders measure the business effect of the service? For example, improved bench strength or successful merger and acquisition activity?

- How will strategic reflection happen to apply design thinking and build a “coalition of the willing” to help support future service deployment?