Good news, learning leaders. Learning and development investments are growing. Spending priorities appear to be greatest in strategy, technology and content. Most enterprises expect to continue their technology investment in assessment systems, learning management systems and analytics.

Good news, learning leaders. Learning and development investments are growing. Spending priorities appear to be greatest in strategy, technology and content. Most enterprises expect to continue their technology investment in assessment systems, learning management systems and analytics.

In the 2016 CLO Learning Investments Survey, published this past October, more than 120 CLOs described their intentions to expand learning technology and services use and detailed how their spending will change between 2016 and 2017.

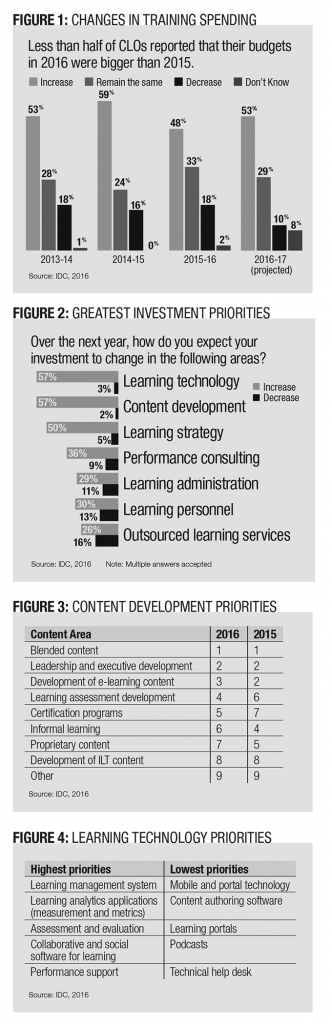

Budgets aren’t crazy different, but there have been some changes. For the first time in four years, less than half of CLOs report their budgets in 2016 were bigger than 2015. About the same percentage of CLOs report their budgets were the same or growing in 2016. (See Figure 1.)

Also encouraging, for the third year in a row, CLOs who saw a budget increase reported an increase of almost 20 percent. However, CLOs who reported a decline estimated their budgets shrank by almost 20 percent. So, while gains were bigger, and there were fewer declines, not all organizations are seeing an uptick.

The trend for budgetary changes looks good for 2017, too. More than 50 percent of CLOs expect their budgets to increase in 2017 and only about 10 percent of firms expect a decrease. Overall, we project training budgets for 2017 will grow about 6 percent on average; about 30 percent of firms expect no change from their 2016 budget.

While some CLOs will see increased budgets, almost all will focus on improved outcomes and continue efforts to link learning and business strategy. More than half of CLOs expect to increase spend on learning technology, strategy and their content libraries — with a focus on leadership and executive development, business skills and general management training, areas to help them run the enterprise as opposed to any specific skills for specific roles — and learning strategy. All of these areas support increased relevance and efficiency, and all offer the most visible results. (Figure 1.) This expands on a pattern to link training to business objectives, and seems to reflect an aim to increase the impact of training spend and delivery.

Other findings related to key budget priorities include:

Other findings related to key budget priorities include:

- Learning technology: Learning analytics, assessment tools and learning management systems will be an investment focus for most enterprises. Organizations want to better evaluate training and to promote high performance. Enterprises are also increasing their spending on performance support technologies. While these take a variety of forms, on-the-job assistance is increasingly recognized as an inexpensive way to increase capability in a workforce that might have expanding responsibilities.

- Learning strategy: The distance between learning strategies and organizational success is narrowing. Learning strategy has increased in importance over the past several years.

- Content development: Leadership development remains a core focus. Learning leaders must prepare the next generation of executives to replace retiring leaders. Other business skills, including negotiation and teamwork, are also important. Providing employees with the appropriate career development has been a high priority since the employment market began to tighten in 2014.

While spending on technology, content and strategy are increasing, after several years “out of favor” and declining as an investment priority, outsourcing learning services remains stable.

Compared with priorities from previous years — blended content, leadership and executive development and e-learning delivery — ILT content delivery continues to decline for CLOs. This reflects the continued and growing acceptance of e-learning, and a focus on cost effectiveness in other spending areas.

Spending on certification content is declining slightly, reflecting a continued need to demonstrate relevance and on-the-job applicability but not an increasing demand for the process or perhaps the specific certification content. Informal learning content is a somewhat lower priority — acknowledging the somewhat ironic requirement to formalize informal training. (See Figure 2.)

Technology remains a major source of efficiency gains, and those efficiencies often come through learning administration. Assessment and evaluation technologies are top priorities as combining these with learning management enables CLOs to target training for maximum benefit.

Overall, 53 percent of CLOs see learning technologies as a significant priority, and 57 percent expect to increase their technology spending in 2017. Learning technologies are behind learning strategy as an overall priority; 74 percent say strategy is a significant priority, though more CLOs expect to increase technology spend more than they expect to spend on strategy.

CLOs are typically conservative when managing their learning investments and aligning these with enterprise priorities. This research suggests learning executives hope to increasingly leverage learning technologies and improved content development. CLOs also will include a healthy dose of learning strategy development, performance and organizational assessments to improve organizational learning’s impact.

Cushing Anderson is program director for learning services at market intelligence firm IDC. Comment below, or email editor@CLOmedia.com.