A merger or acquisition is the union of two firms with different competencies and cultures. When done right, such deals can be a major boon for the future performance of the combined entity. When done wrong, they can ensnarl both firms’ executives in years of untangling that make the initial attractiveness of the deal appear questionable. While most executives are likely to think that a given deal’s success is dependent on the prospects of the new company’s combined financial future, much of that future actually rests on the firms’ ability to meld their human capital.

If leaders can agree that people are ultimately a company’s most valuable asset, largely responsible for a firm’s income generation and earnings growth, then managing the risks and opportunities associated with a merger or acquisition’s people is likely to account for the difference between a deal’s success and failure. Accordingly, it is critical for business leaders to assess the target company’s human capital with the same rigor that is applied to the assessment of its financial statements, products, inventories and other assets and liabilities. This article offers six human capital tools business leaders should consider as they evaluate any M&A deal they’re eyeing.

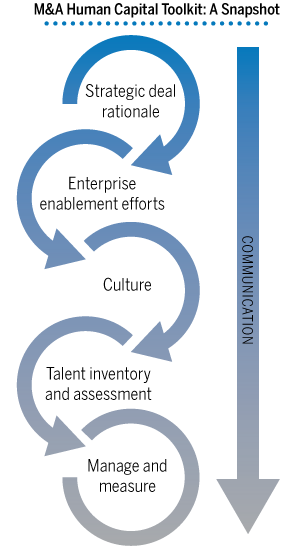

Tool 1: Strategic Deal Rationale

A merger or acquisition is founded on an investment thesis, described as a definitive statement of how the deal will create value for the buyer and associated stakeholders. The deal thesis is supported through financial models for revenue and potential synergies to substantiate it to investors. Regardless of if the deal focuses on entering a new line of business, acquiring new technology and intellectual capital or consolidating a market, the investment thesis becomes the backbone for the deal’s integration strategy. To that end, the first tool in a leader’s human capital toolkit is to clearly identify the deal’s strategic reasoning. In today’s M&A environment, typical rationales include: improving company performance; removing excess capacity from the industry; accelerating growth or market access; acquiring skills or technology more quickly or at a lower cost; and finding emerging success stories and developing their business roll-up strategies, among others. In turn, the strategic reasoning will then determine how deal synergies will be realized along a continuum between an investment-to-integration framework.

This strategic rationale can be used as a lens in assessing human capital factors in due diligence, pre-close planning and post-close integration. The key is for leaders to align their human capital planning with the critical business priorities. For example, I have participated in more than a dozen deals in the pharmaceutical industry focused on mitigating the patent expiry risks by acquiring new products, expansion into new geographies and entering or exiting the market segments such as animal health or consumer products. In addition, vertical and horizontal integrations via M&A have enabled pharmaceutical companies to take advantage of economies of scale, expanded R&D, stricter governmental regulation and international tax advantages.

The human capital issues that may arise in pharmaceutical transactions typically include measuring the cost of redundancies and reductions in force (normally stemming from duplicate functional areas); consolidation of sales forces; shuttering factories or moving manufacturing to lower-cost geographies; and retaining and integrating new leadership and key employees into the desired future state organization and culture. At the executive level, change-in-control payments can lead to post-close retention issues especially for leaders of key products or business lines. In more traditional pharmaceutical companies, large pension or post-retirement benefits obligations in an era of record-low interest rates can lead to underfunded liabilities or poor investment performance. These items can lead to substantial purchase price adjustments during the transaction and impact employee retention and morale depending on the post-deal total rewards package design.

The human capital issues that may arise in pharmaceutical transactions typically include measuring the cost of redundancies and reductions in force (normally stemming from duplicate functional areas); consolidation of sales forces; shuttering factories or moving manufacturing to lower-cost geographies; and retaining and integrating new leadership and key employees into the desired future state organization and culture. At the executive level, change-in-control payments can lead to post-close retention issues especially for leaders of key products or business lines. In more traditional pharmaceutical companies, large pension or post-retirement benefits obligations in an era of record-low interest rates can lead to underfunded liabilities or poor investment performance. These items can lead to substantial purchase price adjustments during the transaction and impact employee retention and morale depending on the post-deal total rewards package design.

Tool 2: Enterprise Enablement Efforts

Capturing sustained economic value after a deal has closed is the most significant challenge for inorganic expansion. This leads me to the second tool in the human capital toolkit: aligning the enterprise enablement efforts with the levers for value creation.

During due diligence, human capital practitioners can begin to identify how deal synergies can be realized through the careful alignment of people requirements to operationalize deal objectives. For example, a few years ago I participated in a large multinational deal with a mature company that had significant talent tenure and retention in their international locations. We used a multipronged approach and several unique human capital M&A tools to complete a preliminary talent assessment, cultural inventory and a total rewards inventory and valuation. What was discovered was that most of their high-potential talent (longest future runway) were currently on rich expatriate assignments and within-country high-performing talent had significant tenure with valuable vested pensions and equity holdings. Many weeks and months were spent valuing and developing a post-close total rewards and retention package in addition to developing the talent “non-negotiable” list to ensure success of the conveyed assets and inventory.

The open secret about M&A is that most deals fail to generate the expectations they promised when they were announced. As shown in a 2014 study by management consulting firm Bain & Co. that analyzed 150 mergers announced between January 2000 and July 2013, the top five root causes of deal disappointments or difficulties are:

- Due diligence failed to highlight critical issues.

- Overestimating synergies from combining the companies.

- Failure to recognize insufficient strategic fit.

- Failure to assess cultural fit during due diligence.

- Problems integrating management teams and retaining key talent.

In reviewing these results, it is clear to see that the majority of findings have significant human capital components. Human capital practitioners can improve M&A results through a rubric during due diligence to create a framework that allows executives to align the people requirements with the prioritized priorities.

Tool 3: Culture

When aligning the enterprise enablement efforts with the levers for value creation it is important for business leaders to bring in the third tool in the human capital toolkit: culture. Culture matters, often more in multinational deals. While it is provocative to see new countries added to a company’s sales force or manufacturing footprint, organizational fit and national differences can lead to unprecedented complexity and cultural variability. Integrating company cultures is not the same as integrating business processes — it is not possible to hand pick the best practices and rationalize workflows when organizational culture spans borders and functional boundaries.

Today’s multinational deals present difficult decisions for business leaders, even those who prioritize culture. In a review of complex global organizations, James Heskett, author of the 2011 book “The Culture Cycle: How to Shape the Unseen Force That Transforms Performance,” observed that, in many cases, developing a “one company” culture is very difficult and uneconomic to achieve. A common set of values may be the most a global organization can hope to achieve, but, as Heskett writes, how those values are interpreted will be based on local assumptions and practical application.

Today’s multinational deals present difficult decisions for business leaders, even those who prioritize culture. In a review of complex global organizations, James Heskett, author of the 2011 book “The Culture Cycle: How to Shape the Unseen Force That Transforms Performance,” observed that, in many cases, developing a “one company” culture is very difficult and uneconomic to achieve. A common set of values may be the most a global organization can hope to achieve, but, as Heskett writes, how those values are interpreted will be based on local assumptions and practical application.

As I noted earlier, culture is one of the top reasons deals fail to meet expectations. I can speak to several critical lessons learned from integrating organizations with far different risk tolerances, power structures, achievement norms, business time horizons and communication expectations. The executive summary: it is complicated and challenging work. Variations in these contexts can lead to significant employee dissatisfaction, delayed deliverables and increased costs as an organization works to overcome these silent impairments. Just as planning for business integration requires assessment and planning, cultural integration spans a continuum as well.

Cultural alignment should support the deal’s value proposition and the targeted business’ objectives. This can be influenced by the goals of the deal synergies and the expectations of the post-close organization to enable the desired business outcomes based on the investment thesis. It is highly likely that, until the deal closes, human capital practitioners cannot develop an objective and empirical understanding of the target’s cultural variability. Upon close, there are several tools available to conduct a cultural inventory within the first 100 days post-close that can create a strong evidence base to enhance the enterprise enablement plan.

Tool 4: Talent Inventory and Assessment

Another mitigating factor in aligning the enterprise enablement efforts is the fourth tool in the human capital toolkit: talent inventory and assessment. Decisions regarding people investments that enable the organization to capture deal synergies, achieve its business strategy and meet performance goals are strategic differentiators. Early and swift selection of key talent for the transition is critical to minimize uncertainty, assign accountability, define functional authority and clarify roles and expectations. Like culture, conducting a meaningful talent assessment of the target will probably not happen until after the deal has closed. Still, a multipronged approach to developing an exhaustive talent inventory could be conducted pre- and post-close through the appropriate tools.

By prioritizing the key business strategies, actions and barriers, human capital practitioners can then identify the people requirements for the post-close deliverables. Conducting a high-level inventory of the target’s current leadership and key talent for products, projects or technology pre-close can lead to the development of a talent table of key employees required for the transaction and help frame their retention requirements. Since no two deals are alike, human capital practitioners will need to be creative and flexible in due diligence to gain insight around the target’s talent.

On one deal I participated in a few years ago, there was a due diligence dinner where each senior leader was given a short list of who to talk to and what questions to ask. The top two roles of each of the target’s talent had been identified to ensure we understood a high level fit assessment and to understand their level of interest in joining us post-close. In other instances, more specific role profiles can be developed to assess the gap between current or post-close talent (which includes the acquirer’s talent pool) against the organizational needs, key deliverables, required skills and technical expertise, and ideal behaviors needed to achieve the deal deliverables.

On one deal I participated in a few years ago, there was a due diligence dinner where each senior leader was given a short list of who to talk to and what questions to ask. The top two roles of each of the target’s talent had been identified to ensure we understood a high level fit assessment and to understand their level of interest in joining us post-close. In other instances, more specific role profiles can be developed to assess the gap between current or post-close talent (which includes the acquirer’s talent pool) against the organizational needs, key deliverables, required skills and technical expertise, and ideal behaviors needed to achieve the deal deliverables.

If human capital practitioners approach talent inventories and assessment through talent rubrics, they can prioritize by asking the following:

- Which jobs have the biggest impact on our key deliverables?

- Who are our (the acquirer’s and the target’s) high potentials/top talent (depending on how your organization defines it, this can be measured by their ability to make and execute on key deliverables or decisions, longest runway for future roles, etc.)?

- Who can we tap for a stretch assignment to deliver on synergy or integration or post-close business deliverables? If so, who can we pull from our bench to backfill high potentials/top talent roles?

- And who can we tap to mentor employees with stretch assignments? For the target company, ensure key talent based on initial assessment will be conveyed with the deal (no exceptions) and identify what incentives, retention package and role will engage and retain them post-close.

- How do we ensure top performers have the greatest impact on mission critical deliverables or decisions?

Using these questions and other decision-focused talent assessment frameworks can articulate what metrics matter when determining who is tapped for the most important roles. Post-close, human capital practitioners can assess and prioritize how the target’s performance management and talent development cycle aligns with the acquirer’s established philosophy and procedures to create a meaningful talent inventory and assessment opportunity for the combined organization moving forward.

Tool 5: Manage and Measure

The disruptive nature of M&A and the integration process creates an opportunity for a broad performance improvement agenda to take advantage of optimizing beyond pure scale benefits. This leads us to our fifth tool in the human capital toolkit: manage and measure.

Mergers and acquisitions rarely fail due to flawed strategy; most fail due to failed executive synergy generation or failed execution of the deal strategy. To take a page from preventative medicine, building a strong work plan, enabling the development of a deal integration team and articulating clearly what measures matter will lead to better post-close outcomes. This aligns with McKinsey & Co.’s decade-long research into organizational health. McKinsey’s work on this front, as shown in the April 2014 issue of McKinsey Quarterly, indicates that health of an organization is based on the ability to align around a clear vision, strategy and culture; to execute with excellence; and to renew the organization’s focus over time by responding to market trends.

To realize the deal’s rationale of stated synergies and optimization efforts, teams are given more aggressive targets and benchmarks. The organization’s mission and metrics should be tailored to identify and execute against clearly measured synergy and optimization targets. For example, in areas that will deliver the most value, in my past deals I’ve used benchmarks and industry-specific scaling data to frame the gap between the post-close realities vs. the desired future state. Benchmarks are not perfect, but in today’s landscape of global consolidation, knowing where to expect the greatest synergies down to the sub-function level — especially in enabling functions like finance, HR and information technology — can assist in developing a quantitative framework to manage and measure leaders’ post-close business model. Leveraging benchmarks can allow combined entities to set aggressive goals and identify the talent needed to achieve superior results.

Tool 6: Communicate, Communicate and Communicate

Lastly, as the deal workflow continues to develop and emerge, the sixth and continuous tool in the human capital toolkit is to communicate. Communicating early and often with all stakeholders — vendors, suppliers, customers, employees, investors, stakeholders and the surrounding communities that are affected by your organization — creates a consistent tone and theme. The demand for communication has become cliché, but when well-planned, business leaders’ communication toolbox is a strategic differentiator. I have worked on incredibly complex deals where communication to internal and external stakeholders operated within a separate work stream with clearly accountable parties and milestones that stretched for more than a year. Clearly articulating timing for key actions, candid transparency about the knowns and unknowns and creating easy-to-use feedback loops with all constituents allows for real-time modifications to the best-laid plans, truly a strategic differentiator.

This article has given business leaders an overview of what human capital tools matter within the M&A environment. By clearly stating and communicating the deal thesis, the strategic rationale will frame deal synergies and align people investments with business expectations. Defining an integration strategy by aligning enterprise enablement efforts with the human capital levers for value creation creates a clear path for post-announcement activities. Completing cultural assessments pre-close and post-close is crucial to deal success and the formation of the new organization. Conducting a complete talent inventory and assessment will identify the people investments needed to enable the future state organization, capture deal synergies and achieve future state business and performance goals. The best way to operationalize the plan is through clear measurements and management of milestones and people investments through accountability.

Lastly, developing a robust and enduring communication plan, communication vehicles and feedback loops to monitor and measure progress while allowing for real-time feedback and modifications creates a human capital toolkit that will be a strategic differentiator in your next M&A situation.

Stacey Petrey is president of human capital consulting firm Petrey & Co. To comment, email editor@talenteconomy.io. This article originally appeared in the Spring 2017 issue of Talent Economy. Click here to view the digital edition of the journal.