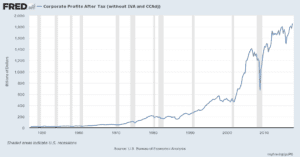

As James Bessen, executive director of the Boston University School of Law’s Technology & Policy Research Initiative, sees it, there is strong evidence that corporate profits in the United States have risen solidly in recent years. What is less clear, he said, is why.

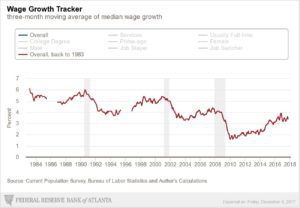

According to the U.S. Bureau of Economic Analysis, as published on the Federal Reserve Bank of St. Louis website, corporate profits after tax rose steadily from 1947 through 2000, at which point they rose dramatically and continue to rise to this day — with the exception of the recession of 2008-09 and the fourth quarter of 2015. Nevertheless, wage growth during that period has mostly declined or remained stagnant, while only recently beginning to show signs of ticking up, albeit at an underwhelming clip, according to data from the Bureau of Labor Statistics, as published on the Federal Reserve Bank of Atlanta website.

We interviewed two experts who share what they say are four main reasons why these two trends are heading in opposite directions.

1. Corporate investments are paying off.

Much of the rise in corporate profits can be attributed to corporate investments in information technology and research and development, Bessen said. Large companies, such as banks or retailers, have proprietary systems custom built for their specific business functions, putting them at a competitive advantage in terms of productivity. This leads to large returns on investment and therefore higher profits, in turn passing wage growth on to the employees — but only at those large companies, Bessen said. The same doesn’t go for the average company.

“What you tend to see is that the differences in wages between companies are bigger than the differences within companies,” Bessen said. “A lot depends on who you work for.”

2. Industry concentration is increasing.

In Bessen’s September 2017 paper, “Information Technology and Industry Concentration,” he finds that because the proprietary software at large companies increased their productivity, they can grow faster. Bessen finds that use of these systems allows for the top few firms in each industry to have higher operating margins than their smaller competitors.

RELATED: Welcome to the Talent Economy

“That sounds just right to me,” said Mark Schug, professor emeritus at University of Wisconsin at Milwaukee. And with the new tax bill passed this week, which features lower corporate taxes and the ability to write off business investments for five years, more investment will go on at small companies that can take advantage of the investment processes their larger competitors put in place, Schug added.

3. Low interest rates contributed to high investment and profits.

Much of why companies have been making investments in technology can be attributed to low interest rates. Interest rates set by the Federal Reserve that in turn influence the cost of capital in the economy dropped in 2009 — from 6.25 percent to 0.5 percent — and remained at 0.75 percent until February 2016, according to the International Monetary Fund’s data on the Federal Reserve Bank of St. Louis’ site. Lower interest rates make it cheaper for companies to borrow money to invest and grow.

“Businesses that have been doing expansion have benefited a lot from having those low interest rates,” Schug said.

4. Older workers retiring pushes down wages.

About 10,000 workers reach retirement age each day, according to Pew Research and the Social Security Administration. Because these workers are at the end of their careers, they tend to have the highest wages. Once they retire and a younger worker takes on their role, companies employing them can dole out lower wages, Schug said. Younger, less-experienced workers simply can’t command higher salaries — at least not yet.

Future Profits and Wages

“Just seeing a trend doesn’t mean that that’s the way it’s going to be forever,” Schug said. There’s an inclination to assume that wages will continue to stagnate because they have historically. However, the economy constantly moves and changes. The increasing profits firms see today can’t increase more than the economy grows. “But eventually, profits have to come back to Earth,” Schug said.

As the economy adapts, so can businesses. How smaller companies can get a greater share of those high profits depends on their ability to compete, which sometimes requires changing business models and people acquiring new capabilities to adjust to that change, Boston University’s Bessen said.

And to do so, companies must invest in their people. “It’s about hiring talented people, paying them well and having them apply their talents to implementing new technology,” Bessen said.

Lauren Dixon is an associate editor at Talent Economy. To comment, email editor@talenteconomy.io.