Investment in learning and development has reached equilibrium. Overall, investment in learning technologies and services did not rebound as much as expected in 2010 — with about as many firms increasing their spending as decreasing it compared with 2009.

Going forward, investment in learning technologies continues to be a priority compared with most other spending alternatives. Custom content development appears to be the area expecting the most growth in the next 12 to 24 months.

Every other month, IDC surveys Chief Learning Officer magazine’s Business Intelligence Board (BIB) on a variety of topics to gauge the issues, opportunities and attitudes that are important to senior training executives. For the past several years, members of the CLO BIB have been asked to provide annual insight into their investment choices. This month, we look at how companies are investing their training dollars in learning technology and learning services areas and whether spending on training will increase or decrease from 2010 to 2011.

Budgets Declined Slightly

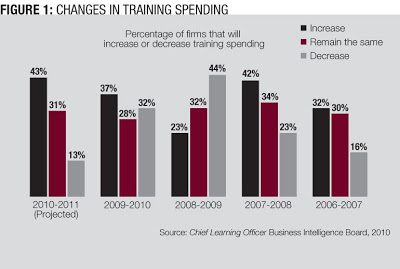

As seen in Figure 1, on average, training budgets continued to decline as a result of the global economic crisis. A plurality of firms saw a gain in budgets, with about 37 percent of CLOs experiencing an increase and about 32 percent seeing a decrease in 2010. The average impact on budgets was a slight decline of about 2 percent — with firms that saw a decline reporting a decline of about 6 percent and firms that had larger budgets growing about 4 percent.

The trend for changes in training budgets looks much better for 2011. Almost 45 percent of enterprises expect an increase in budget for 2011, which exceeds the increase we saw in 2007 to 2008. Overall, CLOs suggest that budgets for 2011 will grow slightly — about 4 percent on average, with about 30 percent of firms seeing no change from their 2010 budget.

Key Investment Areas for 2011

CLOs continue to use their training dollars efficiently, spending most on important areas. Budget distribution is fairly consistent with prior years, with about 25 percent of all learning and development budgets focused on personnel and about the same amount spent on training content. As seen in Figure 2, technology spending has been growing and now represents about a fifth of all spending on training.

More than half of CLOs expect to increase investment in content development and learning technologies. Also interesting is the dramatic increase in strategy design and performance consulting. CLOs report that strategy involves two different levels of understanding: first, to better align their learning investments with organizational priorities, and second, to develop a strategy to better deliver training using the various delivery options.

Where to Spend

Examining spending patterns within content libraries illustrates where CLOs believe the most impact can be felt in their organizations. This list of priorities for spending in 2011 is consistent with prior years. The four areas where CLOs plan to spend the most money are:

• Leadership and executive development: Includes executive skills, strategic planning and personalized coaching.

• Compliance: Includes both training as a compliance activity and training to support thorough understanding of compliance activities and processes.

• Business skills: Includes negotiation skills, meeting facilitation, teamwork and project planning.

• Career development: Includes industry- and job role-specific skill development programs.

Leadership and executive development remains a high priority for most organizations. Programs to support executive development have maintained their importance in spite of cuts to other areas. CLOs reported that leadership and executive development programs are not only a good value, but also highlight influential stakeholders’ need for learning and development organizations.

Spending on general business skills and career development is often highly discretionary. These programs can see sizable, temporary cuts in difficult economic situations. A return to spending in these areas can be interpreted as an indicator of a recovery in progress.

Generally speaking, investment in content is increasing. CLOs not only intend to spend more in 2011 on content, but also increase the share of their budget they are allocating to content from about 22 percent in 2010 to an anticipated 24 percent in 2011.

Buying Tech

Companies are continuing to invest in their technology infrastructure. More than 25 percent of CLOs’ technology budgets are spent on learning and content management systems. Learning content authoring tools and virtual classrooms together represent about 15 percent of a CLO’s technology spending, while mobile and portal technologies represent about 10 percent. This characterizes a consistent pattern from recent years. Administration and delivery costs represent about equal shares of a CLO’s technology spending. Going forward, CLOs will be spending more on delivery options and content creation and less on administration, as software-as-a-service models take hold and organizations continue to rationalize their learning administration portfolios.

Overall, about half of all companies are expecting to spend more on learning technologies. With that, the share of all learning budgets spent on technology is growing, from about 19 percent in 2010 to 20 percent in 2011.

Still Blended

CLOs are using the full range of options for learning delivery and allocating time and money to develop both information and learning technology and e-learning courses. However, organizations spend about one-fifth of their development budget on e-learning content — almost twice the amount spent developing information and learning technology courses.

As found in CLO BIB research earlier this year, classroom training is being used more often, though the combination of synchronous and asynchronous e-learning still represents a growing modality. As seen in Figure 3, in 2010, CLOs increased their use of classroom delivery because of the ease of creation and a corporate mindset to avoid sending students to external classes or purchasing external e-learning courses. Though organizations estimate they are using formal on-the-job training for about 20 percent of their training, it represents only about 10 percent of the spending on content development, making it the most cost-effective alternative.

If Money Were No Object

Most CLOs and senior training executives responding to the survey report that they have refocused their dreams on more practical ideas. There were the occasional wishes of advanced technology gadgets — from iPads to Second Life — but most desires were highly practical and their benefit to the organization was tangible, with respondents stating, “I would like to outsource more of our computer-related training” and expressing a desire for “better selection of graphics and functionality for authored courses.”

It is commonly recognized that companies need effective training programs in order to transfer knowledge and skills to employees, customers, and partners, to retain employees and to improve speed to proficiency. The approach to that knowledge transfer can vary: Training programs can be grown organically over time; developed in-house; outsourced to a training provider; or implemented using some combination of in-house and external expertise.

The decision to outsource often rests on whether the needed volume and quality of training can be supported by internal staff. Overall, those enterprises that do outsource training are satisfied with the services they receive and plan to maintain or slightly increase spending levels for 2011. More than 40 percent of enterprises use an outside provider to provide part of their training function.

In past years, integrated technology solutions were on most wish lists. This year, like last year, wish lists were often focused on learning management systems, content authoring tools, improved access to content libraries and content management software. Integrated talent solutions are important not simply because of the efficiency gained in learning administration. Integrated learning environments can improve employee performance and may also be a way to win back the commitment of disaffected employees. According to a vice president of learning and development at a defense contractor, “Senior leaders are coming to understand the importance of employee engagement to talent management.” Integrated learning management may be useful in helping organizations build and present the most relevant content to their learners. According to a learning executive at a national insurance company, “Buying a system focused on talent management created awareness of [the] benefit of integration.”

Also frequently mentioned as a place where increased spending is desired was staff to develop, deliver and even market learning programs. In an era of downsizing and keeping organizations lean, the loss of staff has created pressures throughout the learning organization.

The most dominant element of the wish list was having better or different learning content and tools. Other desires reported included:

• Adding more virtual professional development courses.

• Executive and management development.

• Simulations for health care professionals.

• A learning management system or LCMS that is plug and play.

• Content development, blended learning and virtual classroom software.

Still Doing More With Less

For the most part, training investment priorities are consistent with financial pressures, but there are small rays of optimism in spending patterns and intentions. While CLOs are managing their learning investment portfolios, changes in priorities in investment areas reflect an ongoing effort to provide the maximum company benefits with limited resources. As CLOs enter 2011, they are focused on continuing to improve their training delivery and leveraging various delivery modalities to suit their audience and content. Finally, CLOs leverage technologies to achieve their goals of supporting organizational learning and change, but ultimately, the right people and the right content are the most important assets.

Cushing Anderson is the program director of learning services at IDC. He can be reached at editor@clomedia.com.