There’s little argument that we live in a time of rapid technology disruption.

A host of new consumer-like platforms and tools fueled by machine learning are putting learning into the hands of learners in the way they like it, wherever they are at whatever time they choose. An unprecedented variety of rich content is available at the moment of need with the swipe of a finger or the click of a mouse.

At the same time, legacy systems continue to deliver important and useful — if sometimes unglamorous — services to the organization. This reality puts chief learning officers in a tough spot.

Technology investments are increasingly central to learning strategy yet increasingly fragmented among an array of legacy platforms and emerging applications.

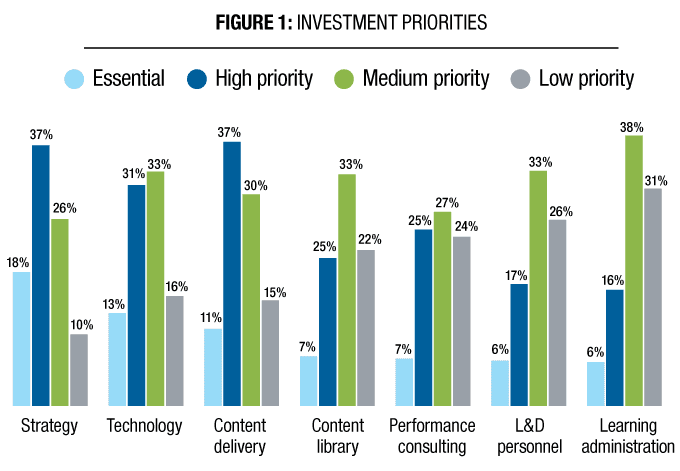

According to a survey of the Chief Learning Officer Business Intelligence Board, technology is a key part of L&D investment plans. Forty-four percent of learning executives see it as either an essential or high investment priority and 33 percent rate it as a medium priority (Figure 1). Technology ranked just slightly lower than their top priority, strategy.

The Chief Learning Officer Business Intelligence Board is a group of 1,500 professionals in the learning and development industry who have agreed to be surveyed by the Human Capital Media Research and Advisory Group, the research and advisory arm of Chief Learning Officer magazine. This survey was conducted from June to July 2017.

The Chief Learning Officer Business Intelligence Board is a group of 1,500 professionals in the learning and development industry who have agreed to be surveyed by the Human Capital Media Research and Advisory Group, the research and advisory arm of Chief Learning Officer magazine. This survey was conducted from June to July 2017.

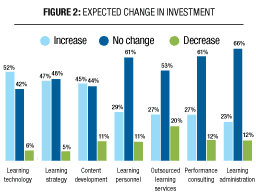

That high priority for technology is reflected in spending plans (Figure 2). Among potential spending categories, learning executives listed learning technology as most likely to see an increase in spending. More than half (52 percent) plan to increase spending, 42 percent plan to keep it the same and only 6 percent plan to decrease spending.

The dollar amounts at stake are not insignificant. Learning management systems alone account for $4 billion of the $130 billion corporate training market, according to estimates from Bersin by Deloitte.

But some of the systems resulting from those past investments are getting long in the tooth. According to the Sierra-Cedar 2017-18 “HR Systems” survey of 1,300 organizations, enterprise learning management systems have been installed on average five years, longer than any other HR application with the exception of payroll and core HR systems.

As a result, organizations are considering replacing or adapting learning applications at a higher rate than other talent management applications. According to Sierra-Cedar, 14 percent plan to replace their system and a further 24 percent are evaluating their options in the next 24 months.

CLO Business Intelligence Board data confirms that finding. Twenty-two percent of surveyed learning executives plan to make the LMS a spending priority in 2018. The top qualities they are looking for in a replacement are reasonable price (62 percent), ease of use (57 percent), product features (45 percent) and analytics capability (44 percent).

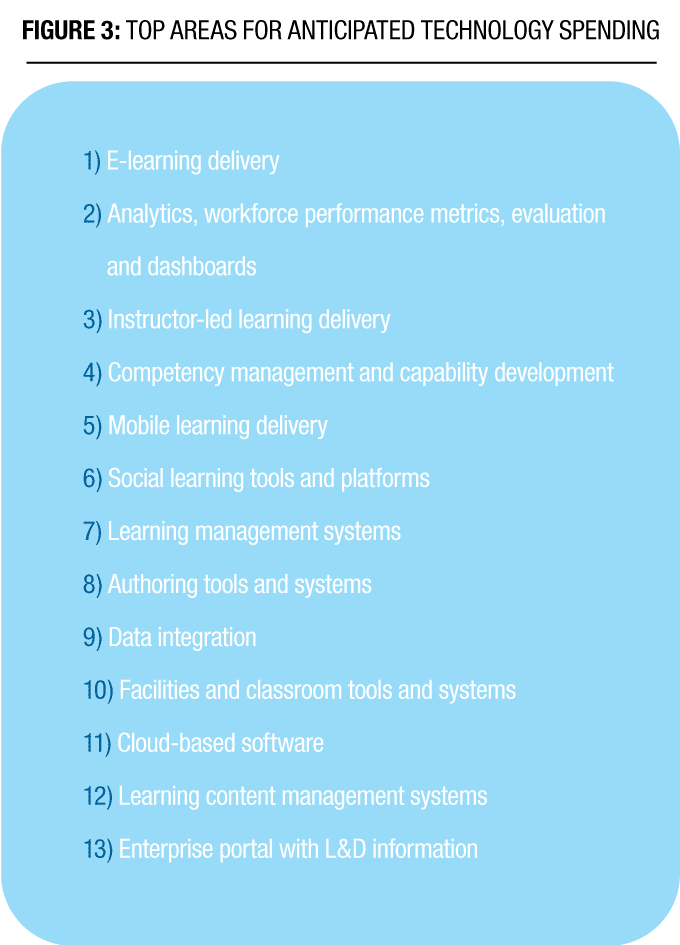

Beyond the LMS, CLOs plan to invest in a variety of learning technologies (Figure 3), including e-learning delivery (46 percent), workforce analytics and dashboards (38 percent), instructor-led learning delivery (30 percent), competency management and capability development (26 percent) and social learning tools and platforms (23 percent).

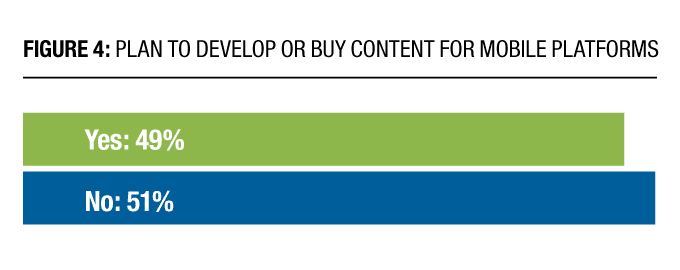

Despite its allure, mobile learning comes in comparatively low on the priority list (24 percent). On-the-job support is the type of content most commonly being developed or purchased for mobile (46 percent), followed by information resources (42 percent), learning apps (40 percent) and simulations and games (29 and 21 percent, respectively).

Disruption may be upon us but CLOs’ investment plans show caution as they plot the future of their learning technology.

Mike Prokopeak is vice president and editor in chief of Chief Learning Officer magazine. Comment below or email editor@CLOmedia.com.