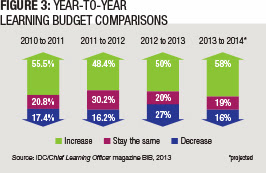

It seems as if the global recovery continues to take hold. More than half of CLOs report higher budgets in 2013 than in 2012, and many expect this year to be better still.

Learning leaders plan to increase spending to develop in-house content, e-learning and install learning technologies, partly because of pressure to deliver more training content to the widest possible audience. But opinions on how to accomplish that are mixed. Technology remains an important part of the solution, but the application of social and mobile technologies is both highly anticipated and skeptically received.

Every other month, market intelligence firm IDC surveys Chief Learning Officer magazine’s Business Intelligence Board on a variety of topics to gauge the issues, opportunities and attitudes that are important to senior learning executives. For the last several years, members of the board have been asked to provide annual insight into their outlook for the year ahead. This month we compare how CLOs feel about their prospects in 2014 compared to recent years.

Bright Times Ahead for 2014?

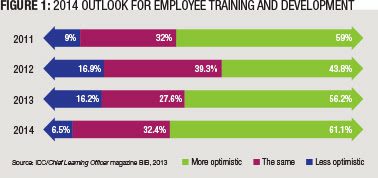

For the second year in a row, more than half of CLOs are more optimistic about the year ahead (Figure 1).

Economic recovery is one reason. Learning leaders believe they have passed through a difficult period and that the improving economy has caused a change in business expectations.

One CLO said, “I believe the country is on the right track and the worst of economic issues are behind us.” Another said she is optimistic training is needed to execute strategic plans the organization has created. And several see an ongoing change toward learning from leadership, reflecting a “paradigm shift in our executive management, and continued growth by our company,” as one CLO said.

Others see a different outlook, especially in the U.S. government, which continues to operate under budget constraints, sequestration and hiring freezes. But overall, more CLOs believe the outlook is primarily positive, although mixed economic predictions in the U.S. and abroad cause concern.

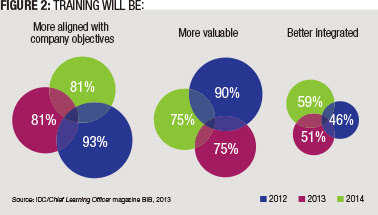

In addition to spending more, companies are expecting positive contributions from the learning organization (Figure 2). For instance:

• 81 percent of CLOs expect training to be more aligned with company business objectives.

• 75 percent of CLOs believe the perception of training within their company will improve compared to last year.

• A steadily increasing percentage of CLOs believe training offerings will be better integrated with other talent management functions.

Leadership and Informal Learning at Work

Some CLOs see leadership as a key tool with which to address deficiencies. “Well-developed leadership programming throughout from entry-level employees through senior leaders” is essential, said one CLO. This is likely because leadership training has been neglected for too long or because “more effective leadership translates directly to improved employee engagement, higher levels of customer satisfaction and ultimately profitability.” Either way, organizations feel leadership training is among the most important activities they will undertake in 2014.

Competencies remain near the top of the list and reinforce last year’s findings that effective competency management represents a significant opportunity. “Clear competencies drive all other talent development tactics,” said one CLO. But the role of competencies extends beyond training to talent management. Another CLO said competencies are weighted for hiring and promotions.

Another key activity with significant effect is learning technology, which remains a priority for CLOs. Learning management systems will be the most significant learning technology investment for most enterprises, though the mix and breadth of technology used in learning continues to expand. Other technologies include assessment and evaluation, performance support technologies and various forms of e-learning.

Mentoring is also important, as CLOs believe it is essential to support transfer of learning, support the employee and build a connection with the mentee. While this requires formal relationships and activities, CLOs believe it is the best way to duplicate success over time without impacting the bottom line.

CLOs said there are also several items that may negatively contribute to training performance in 2014, including:

• Training outsourcing: A common complaint seems to be “whenever we outsource our training, the company we’ve outsourced to is more focused on completing their contract versus actually looking at our long-term success as impacted by what they bring.” Further, some CLOs think outsourcing training runs counter to their organizational intentions. “A strategic objective for 2014 is to become a trusted adviser with our business. If we outsource too much training we lose the ability to interact and build relationships with our clients. If jobs are lost, morale will decrease.”

• Mobile training: Some CLOs see the potential, but not yet. Some say they do not have bandwidth to address mobile technologies. In other cases, the use case is less clear: “We are being asked to deliver in the mobile learning arena but aren’t really sure what to deliver.”

• Compliance training: Compliance training is still considered compulsory, because employees feel they are forced to complete this training on low- or no-value subjects due to compliance requirements.

Who and What Requires More Attention?

For 2014, CLOs believe the learning industry should focus more attention on the role of mobile and social learning. On the other hand, a sizable percentage of CLOs think the learning industry already spends too much time talking about mobile and social learning.

Further, because many employees use their smartphones and tablets during the day, some CLOs said it is important to incorporate technology that is integrated into a person’s daily routine to have more acceptance. On the other hand, some believe mobile learning just causes confusion because learning on the go doesn’t give development the necessary value or weight.

There is more consensus about measurement. One CLO said, “Focusing on business metrics tied to training is more critical than ever considering the economy and how business continues to cut budgets.” This is because without measurable and measured impact there is no evidence of results. The training function is increasingly being asked to demonstrate its value in business terms.

What’s Coming Down the Pike

Even as the economy and learning spending recover, much about 2014 remains uncertain. Some CLOs think increased investments in learning and development are afoot (Figure 3). Others are more cautious: “Training budgets will tighten, and as a result more focus will be put on proving that learning provides value.”

In 2014 CLOs predict that challenges and opportunities that range from boomers retiring to advanced technologies will create an exciting environment. Generally, learning leaders are optimistic: “A new form of learning will emerge (at least in name),” and there may be “more demand for education by those employed, wanting the question answered, ‘What’s in it for me in the long run?’”

CLOs’ most common predictions focused on learning results in several dimensions:

• Training for results: There will be more focus on learning results, including more social, mobile and gamification.

• Action learning: Job- and role-based development and learning paths will include on-the-job development and assignments.

• Relevance: It is increasingly important to make demonstrable contributions to the organization’s bottom line.

• Accountability: More structured online programs will emerge with businesses requiring certain levels of accountability and testing in key areas of knowledge and skills.

• Less waste: The training industry will be more focused on business goals and will use shorter modules organized into larger learning themes. There will be more use of mobile technology to deliver learning and performance support.

• Measurement: The industry will look at how to better relate training to performance measures.

Other predictions focused on content and methods, especially the increased use of mobile. CLOs said the training industry needs to come to grips with anytime, anywhere training, allowing individual pace and differentiated learning. Mobile training will increase and mobility on smartphone use is key.

Technology use is always a hot area for predictions. Though some believe training costs will increase with technology use, most CLOs see it as a strong benefit. There will be:

• More use of e-learning such as webinars.

• Embedded augmentation of learning.

• Leaders embracing gamification as a method to educate and integrating gamification on mobile devices.

• Content development focused on bite-size learning pieces that are reusable, easily accessible and mobile, and cater to various audiences in multiple locations, providing more meaningful learning opportunities at point of use for the learner.

• New learning systems and methods introduced in 2014. The synergy of electronic, tablet and mobile learning will continue.

• Increased importance of performance support.

Finally, while some think changing modalities will cause live, face-to-face training events to increase as demand for dedicated group learning time increases, most believe social networking use also will increase. CLOs’ general consensus appears to be that more social media and collaboration tools will be the basis for learning, with more YouTube-type formats within companies.

Overall, CLOs see an expanding role for, and impact from, employee development. Leadership development and competency management will have the most profound effect on organizational development. And while there is debate about the efficacy of mobile and social learning, CLOs believe increasing use of those technologies and others will continue, and that “as the U.S. economic conditions improve, employment will continue to trend up and training will again be in high demand.”

Cushing Anderson is program director for learning services at market intelligence firm IDC. He can be reached at editor@CLOmedia.com.